Views: 0 Author: Site Editor Publish Time: 2023-11-29 Origin: Site

Written by | Joy

Special Researcher | Liao Yangyong

In 2023, the overseas expansion of energy storage will be another popular industry after the overseas expansion of new energy vehicles.

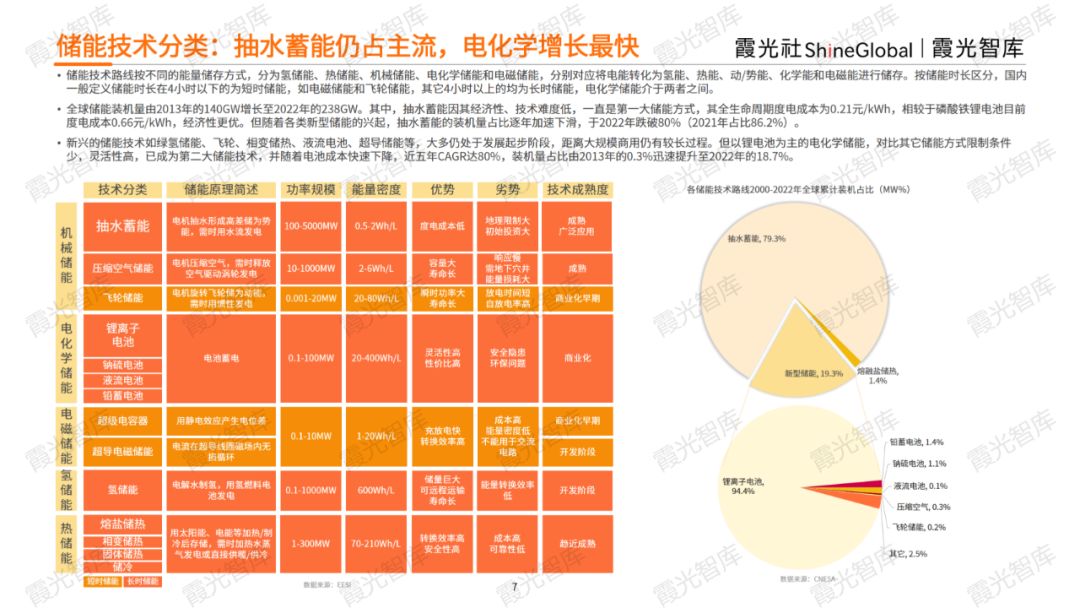

In August this year alone, five energy storage companies won overseas orders, setting a new high for the year. Among them, Honeycomb Energy’s energy storage business has received business orders from many companies in Europe, covering industrial and commercial energy storage, portable power supplies, etc. fields, with a total capacity exceeding 20GWh.Behind this is the great opportunity for energy storage to go overseas in recent years with the European energy crisis, coupled with the rapid development of the domestic energy storage industry and the expansion of production capacity.From a global perspective, global household storage capacity will be newly installed at 7.1GW/15GWh in 2022, with installed capacity increasing by 134% year-on-year compared to 2021.It is expected that in 2025, the newly installed power and capacity of household savings will reach 50GW/122.2GWh, and the global household savings penetration rate will reach 28%.However, the development of the industry is not smooth. In fact, the energy storage industry also faces cyclicality.Since September, energy storage overseas has gradually encountered a cold winter - overseas orders have 'cut off' and stocks have 'fallen off a cliff'. Not only the leading large company CATL said that this year's overseas market is 'pre-cooling' ', many small and medium-sized energy storage companies, faced with 'survival attacks at home and abroad,' where will the next market be?Where are the next orders?Becoming the most concerned at the moment.When the domestic energy storage market is overcapacity and competition in the industry is intensifying, what other overseas markets are particularly worth betting on for household storage entrants?What is the profile and market structure of household savings in different countries?What typical case experiences do household savings industry chains and companies have?Xiaguang Think Tank, a consulting service brand of Xiaguang Society, officially released the '2023 China Household Energy Storage Overseas Report' based on relevant industry data and user surveys. It covers energy storage classification, driving factors for household storage, Europe, the United States, Australia and other household storage markets, etc. Dimension, combined with the cases of global typical household storage companies such as Peneng Technology and Enphase, shows the current situation and future development trends of the global household storage market, hoping to provide useful reference for the household energy storage overseas industry. Energy storage includes different energy storage methods such as hydrogen energy storage, thermal energy storage, mechanical energy storage, electrochemical energy storage and electromagnetic energy storage.Pumped storage has always been the largest energy storage method because of its economical and low technical difficulty. This energy storage method is used in the Three Gorges Dam, which is well known to the public.Electrochemical energy storage, mainly based on lithium batteries, has fewer restrictions and higher flexibility than other energy storage methods, and has become the second largest energy storage technology.

Energy storage includes different energy storage methods such as hydrogen energy storage, thermal energy storage, mechanical energy storage, electrochemical energy storage and electromagnetic energy storage.Pumped storage has always been the largest energy storage method because of its economical and low technical difficulty. This energy storage method is used in the Three Gorges Dam, which is well known to the public.Electrochemical energy storage, mainly based on lithium batteries, has fewer restrictions and higher flexibility than other energy storage methods, and has become the second largest energy storage technology.

Household energy storage systems are mainly used for self-use in households equipped with household distributed photovoltaics. They can save electricity costs while also serving as emergency power sources to ensure the stability of electricity usage.Due to the flexible deployment of electrochemical energy storage, mature mass production technology, and simple installation, operation and maintenance, household storage currently adopts the electrochemical energy storage technology route.Catalyzed by the Russia-Ukraine conflict and natural gas shortages, photovoltaics have become the fastest-growing power generation method. The decline in photovoltaic costs is also conducive to the decentralization of household photovoltaic energy storage to developing markets. The booming development of photovoltaics has driven the popularity of household storage.Under the energy crisis, while global electricity costs are rising, electricity demand is also growing steadily.Due to the old power grid and insufficient power supply reliability, large-scale power outages occur frequently around the world.For example, the power grids built in Europe and the United States in the 1970s and 1980s have entered an aging period. In the United States, more than 120 major power outages occurred in 2020 alone.This has also catalyzed the civilian market for renewable energy and energy storage.Therefore, countries such as Europe and the United States are actively seeking to transform their energy structure and actively introduce relevant tax exemptions and subsidy incentive policies. Driven by the above factors, the household storage market has broad development space. In 2025, the new installed power and capacity of household storage is expected to reach 50GW/122.2GWh. , the household savings penetration rate will reach 28%.

Next, take the United States, Europe and Australia markets as examples to look at the development of overseas household energy storage markets.

The United States is the world's largest energy storage market. Although the base of household energy storage is small, there is huge room for market growth.

The federal ITC and California SGIP policies have a major promotion effect on household optical storage.The 2022 IRA Bill announced that the government will allocate US$369 billion for energy security and climate investment, strengthen the ITC (Investment Tax Credit, investment tax credit), the maximum subsidy can be deducted by 80%, significantly reduce the cost of optical storage configuration, fully It is beneficial to the development of household optical storage.In addition, since 2020, affected by multiple factors such as inflation and the energy crisis, U.S. residential electricity prices have continued to rise. Residential electricity prices in 2023 have increased by 33.5% compared with 2019. At the same time, power outages occur frequently in various states, and the safety of residents' electricity use is not guaranteed. , these factors force more users to consider equipping home energy storage systems.Therefore, the household storage market in the United States has promising prospects. It is expected that the new installed capacity in the United States will reach 13.2GWh by 2025, and the cumulative household storage installed capacity will grow rapidly from 0.51GWh in 2019 to 15.79GWh in 2025.The domestic power grid in the United States consists of three major power grids: the Western United Power Grid, the Eastern United Power Grid, and the Texas Power Grid. The degree of interconnection of regional power grids is low, which also makes the regional distribution of the U.S. energy storage market very different.Among them, California is the first region in the United States to promote clean energy. In 2021, California will account for about half of the installed household storage capacity in the United States. In the long term, California will still be the largest market for household solar storage.The household storage market in the United States is highly concentrated and is almost divided between Tesla's Powerwall and LG Chem's RESU 10H.At present, mainstream household storage is still a single-battery system, with power between 2 and 8kW, battery capacity within 15kWh, and energy storage power supply duration within 3 hours.

Europe is actively promoting energy transformation, has a high degree of power grid connectivity, accounts for more than half of the world's new installed capacity, and is the world's largest household storage market.Among them, Germany accounts for more than 70% and is the country with the largest household savings market in the world.

Since Europe mainly relies on external supply of energy, residents' electricity prices are much higher than those in developed countries in other regions. Italy, for example, has one of the highest electricity prices in the world.The spot price of electricity in Europe is closely related to natural gas. Affected by the energy crisis, electricity prices soared to a record high in 2022, making the electricity price for European household users higher than the cost of household solar energy storage.At the same time, European countries have actively introduced policies such as tax exemptions, feed-in tariffs, and purchase subsidies to encourage users to install rooftop photovoltaics. It is expected that 40% of new photovoltaics will be equipped with energy storage systems in 2025. With the addition of energy storage systems for existing photovoltaics, it is expected that by 2025 The scale of new household savings will be more than ten times that of 2020.European countries are at different stages of optical and storage development, and their policy priorities are also different.Among them, Poland's distributed photovoltaic industry has a low foundation and started late but has rapid development momentum. It is one of the growth markets that household savings need to focus on.

Australia has sufficient lighting resources, ranking first in the world with a per capita photovoltaic installed capacity of 1.05kW in 2021, and a high household photovoltaic penetration rate.Affected by the global energy crisis, the power of household photovoltaic distribution and storage has increased.About 15% of all newly installed photovoltaic systems in 2022 will be equipped with energy storage. Although this is higher than 8% in 2021, there is still a large penetration space for household photovoltaic distribution and storage.According to the IEA, Australia's cumulative household photovoltaic installed capacity is expected to reach 22.3GW in 2025, and the cumulative household storage installed capacity is expected to reach 6.7GWh. Compared with the current market, there is greater room for growth.The decline of grid-connected electricity price FiT, the widening gap in time-of-use rates, rising electricity prices, and falling purchase costs have combined to make the economics of household photovoltaic distribution and storage increasingly prominent.

Due to extremely uneven population distribution, the development of the distributed photovoltaic market across Australian states also shows large differences.Queensland has previously been the largest photovoltaic market, but has been gradually overtaken by New South Wales in recent years.Victoria and New South Wales are the states with the largest newly installed household storage capacity. Victoria provides subsidies of up to AU$2,950 for the purchase of household storage systems, which has promoted the growth of household storage systems.Australia's photovoltaic industry is mature, with many market participants and fierce competition. Local photovoltaic storage manufacturers such as Redflow, GiantPower, Redback and Evo occupy important market positions, and European and American brands such as Tesla and Sonnen are leaders in the mid-to-high-end market.The domestic brand BYD is also one of the major market players in the residential and commercial energy storage fields.

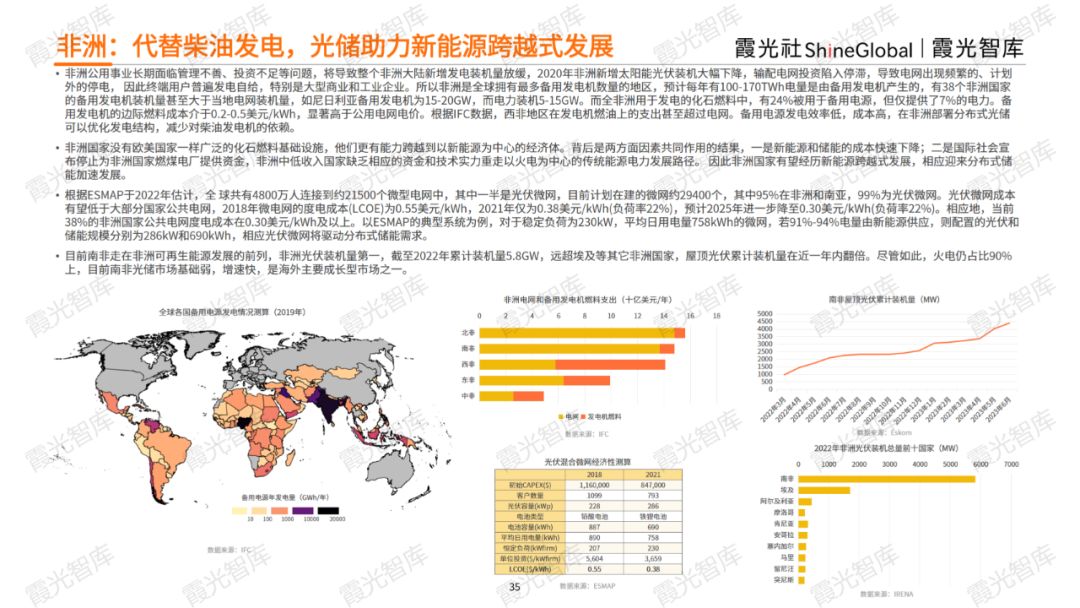

The growth rate of mature markets for household savings has slowed down, and some household savings companies are also targeting emerging markets such as Latin America and Africa.Among them, Latin America has abundant solar energy resources, uneven population distribution, and sufficient land for large-scale photovoltaic construction. However, independent houses account for a relatively small proportion. Therefore, the current photovoltaic market is dominated by centralized power stations, and the development of distributed photovoltaics has not yet started.The energy storage market in Latin America is still in its infancy, currently focusing on the construction of off-meter energy storage, and most countries have not yet introduced energy storage-related policies.On the policy front, Chile has taken the lead and has recently launched policies related to renewable energy storage.Therefore, Chile also leads other Latin American countries in terms of the number of energy storage projects.However, due to the gap between rich and poor, Chile’s household energy storage market space is small.

Recently, the international community has announced that it will stop funding coal-fired power plants in African countries. At the same time, the rapid decline in the cost of new energy and energy storage will also help African countries experience the leapfrog development of new energy and usher in the accelerated development of distributed energy storage.South Africa is currently at the forefront of renewable energy development in Africa. In the second quarter of 2023, South Africa's household savings shipments increased by more than 300% year-on-year.However, thermal power in South Africa still accounts for more than 90%. At present, South Africa's optical storage market has a weak foundation and rapid growth. It is one of the major overseas growth markets.

Chinese companies have outstanding performance in the global household savings market.In terms of shipments, many Chinese manufacturers rank in the top ten for both energy storage and inverters.Among them, Paineng is the leading brand of household savings in the world, second only to Tesla. BYD has suddenly emerged in 2021 and occupies an important position in the European and American markets. In Italy, three Chinese manufacturers, Paineng, Huawei and BYD, have a combined share of more than half.

In the U.S. market, because the government has set high barriers to the entry of Chinese companies, two local companies, Tesla and Enphase, account for nearly 70% of the U.S. household storage market. Chinese companies can only embed themselves into U.S. energy storage leaders. The supply chain of all manufacturers indirectly participates in market competition.Take Chinese household storage manufacturer Paineng as an example. Paineng is the top 2 household energy storage company in the world. In 2021, its household storage market share will be 14%, and its business growth will be impressive.Paineng focuses on overseas To B household storage business. Its main model is to supply energy storage battery systems to downstream integration manufacturers, focusing on the European and African markets.According to the long-term horizontal evaluation released by CleanEnergyReview in 2022, the main product of Paineng household storage has high cycle times, high charge and discharge efficiency, and the cost of electricity is only US$660/kWh, which is lower than competing products. Among the best-selling household storage products Best value for money.With its R&D and production technology advantages and several years of accumulation in downstream channels, Paineng is expected to continue to develop rapidly and maintain its leading position in overseas household savings.In the field of photovoltaic inverters for household storage systems, Chinese manufacturers occupy 8 of the top ten global shipments. Most Chinese inverter manufacturers such as Sungrow, Deye, and Goodwe have complete product lines, including Energy storage, string and micro-inverter products are involved in centralized, distributed industrial and commercial and household photovoltaic fields.However, domestic companies mostly use the dealer model to open up overseas markets and have not yet formed a brand effect overseas. This may become an important obstacle for Chinese manufacturers to go overseas.

According to Woodmac data, global shipments of photovoltaic inverters will reach 330GWac in 2022, a year-on-year increase of 48%.The top ten rankings change greatly every year, and the competition in the photovoltaic inverter market becomes increasingly fierce.Huawei, Jinlang Technology and Shougang New Energy will almost double their shipments in 2022, while SMA and Power Electronics have stagnated and their growth is polarized, indicating that the market will continue to be reshuffled. In growth markets, small manufacturers are still Chances are, the position of the leading manufacturer is not stable.

Follow the official account of China International Trade Fair and reply 'Household Energy Storage' to get the '2023 China Household Energy Storage Overseas Report'.

If you are learning about global energy storage trends and overseas market opportunities, you are sincerely invited to attend the China Cross-Border E-commerce Fair held at the Fuzhou Strait International Convention and Exhibition Center from March 18th to 20th. An energy storage equipment exhibition area will be set up on site, and the exhibits will cover industry Energy storage, home energy storage, mobile energy storage, gas/fuel generators, batteries, solar panels, controllers, inverters, BMS/battery technology and many other energy storage categories, providing communication, cooperation and development for the global energy storage industry platform, we look forward to gathering with you at the China Cross Trade Fair and exploring this sea of stars together.

Reprint source: Xiaguangshe