Views: 0 Author: Site Editor Publish Time: 2023-12-01 Origin: Site

Author | Yinting HouEditor | Liu Jingfeng and Ding Juerui (Senior Editor of The Paper)

Young people from 20 countries along the 'One Belt and One Road' have selected China's 'four new inventions': high-speed rail, scan-code payment, shared bicycles and online shopping.In recent years, as the digitalization process of countries along the 'Belt and Road' has accelerated, China's e-commerce model has also accelerated its introduction into the countries along the route.Among them, Southeast Asia is the hottest market for China’s cross-border e-commerce.After three years of e-commerce explosion, many Chinese cross-border sellers have gradually taken root in the local area, driving the vigorous development of the local e-commerce market.

A report released by eMarketer, a market research organization, shows that Southeast Asia will become the global e-commerce market growth champion with a growth rate of 20.6% in 2022. At the same time, five of the top ten e-commerce growth markets in the world belong to Southeast Asia.With the implementation of RECP (Regional Comprehensive Economic Partnership Agreement), trade between my country and ASEAN (Association of Southeast Asian Nations) has become more convenient, and ASEAN has gradually become my country's largest trading partner.According to data from the General Administration of Customs, in the first half of 2023, the total trade value between China and ASEAN was 3.08 trillion yuan, a year-on-year increase of 5.4%, accounting for 15.3% of China's total foreign trade value.Among them, exports to ASEAN were 1.81 trillion yuan, an increase of 8.6%.During the same period, China's total import and export value to countries along the 'Belt and Road' was 6.89 trillion yuan, a year-on-year increase of 9.8%, accounting for 34.3% of the total import and export value, an increase of 2.4 percentage points year-on-year.From a proportional perspective, the total import and export value between my country and ASEAN accounts for nearly half of the total import and export value of countries along the 'Belt and Road', and its strategic position is evident.Although Southeast Asia's e-commerce has been experiencing turmoil recently, the dividends of e-commerce are still there in this fertile land.Chinese cross-border sellers are following the new trend of going overseas, developing towards localization and compliance, and heading towards global brands.

Lin Chao, the founder of Cross-Border Guide, has been exposed to the cross-border e-commerce industry in Southeast Asia since 2016.

After graduating with an e-commerce major, he joined an e-commerce company in Guangzhou, mainly operating Malaysian cross-border stores on the Korean e-commerce platform '11Street', selling Muslim swimwear.

'At that time, 11Street was the second largest e-commerce platform in Malaysia. Shopee was launched in 2015 and had not yet started in 2016. At that time, the Southeast Asian market had not received much attention, and the e-commerce volume was relatively small. However, the coastal areas of Guangdong have long As an older man, he had heard anecdotes about many Southeast Asian countries since he was a child. He felt familiar with this market and believed that this market had potential, so he entered the market to 'test his skills'.

In May 2017, he resigned from the company and started his own business.He opened a store on the cross-border e-commerce platform Ezbuy and sold mobile phone accessories to Singapore.When purchasing goods from 1688, he found that the goods were all sent from Shenzhen to Guangzhou and 'followed the supply chain.' Three months later, he moved from Guangzhou to Shenzhen.

In January 2018, after accumulating experience for half a year, Lin Chao registered his own company and opened a Shopee store.In terms of suppliers, he also began to purchase directly from places such as Shenzhen Huaqiangbei.Starting from the Malaysia site, then moving to Thailand, Philippines, etc., he gradually opened up the Southeast Asian market, achieving sales of hundreds of thousands of yuan a month.

In 2019, Lin Chao began to notice the trend of accelerating localization of cross-border e-commerce in Southeast Asia. In August of the same year, he went to Thailand to launch local e-commerce business.

In 2020, the epidemic accelerated the development of the e-commerce business ecosystem in Southeast Asia, and many offline practitioners also switched to the e-commerce industry, such as logistics and warehousing service providers, MCN institutions, etc.Lin Chao began to cooperate with third-party overseas warehouses and invested in local store business in Thailand.

Thailand street scene

The Thai market accounts for 95% of the company's 2022 sales performance, ranking among the top in some categories on platforms such as Lazada and TikTok Shop.This year, Lin Chao mainly entered the TikTok Shop business.In addition to Thailand, he also tried markets such as the Philippines and Indonesia.

He said, 'At the end of October, the team wants to go to the Philippines and Vietnam for on-site inspections. Thailand has almost done it, and it is time to explore other markets.'

Like Lin Chao, many sellers are also making a name for themselves in Southeast Asia.In addition to the 3C digital category, other categories are not lagging behind. The small home appliance brand HAN RIVER has become the Top 1 category in Shopee in Indonesia, setting off a trend of small home appliance brands in Southeast Asia.

Lin Sheng, the founder of HAN RIVER, entered the overseas market in 2014, acting as an agent for many big imported brands such as SWISSE and A2.In 2019, the company placed its strategic focus on Southeast Asia and began the road to its own brand.

In 2019, Lin Sheng came to Indonesia for inspection and founded the brand HAN RIVER. The name comes from the mother river 'Hanjiang' in Chaoshan, Guangdong. Its main categories are kitchen appliances and personal care appliances, such as ovens, air fryers, and hair dryers. , hot water kettle, etc.In 2020's 'Double 11', the brand quickly seized the market and became Top 2 in the Indonesian Shopee category.At the end of 2020, HAN RIVER jumped to the top 1 in the Indonesian Shopee category.

He pointed out that when HAN RIVER entered Indonesia, there were only some high-priced foreign home appliance brands such as Japan, and most Chinese small home appliances were white brands. They were the first Chinese small home appliance brand to develop the local market.

HAN RIVER has focused on brand building since its establishment, such as placing advertisements on Facebook, Instagram, and TikTok for exposure, and allowing Internet celebrities to shoot short videos for promotion.During the epidemic, the company also opened an offline experience store in Indonesia, but the flow of people was not good at that time and the store was closed soon.

'In 2020 and 2021, the epidemic has accelerated the growth of a wave of small home appliances (business). Now in Indonesia, (HAN RIVER) has annual revenue of nearly 150 million yuan. 'In addition to Indonesia, HAN RIVER is also in the Philippines, Thailand and It has a presence in Southeast Asian markets such as Vietnam, and its business scale outside of Indonesia also reaches tens of millions of yuan.

In October 2022, HAN RIVER also completed a first-round financing of tens of millions of yuan, and the investor was Xingmailia Group.

It is conservatively estimated that there are more than 10 million Chinese sellers on Shopee and Lazada, the mainstream e-commerce platforms in Southeast Asia. Chinese sellers have become one of the mainstream seller groups on the e-commerce platforms in this market.

In a sense, it can be said that the booming Southeast Asian e-commerce market is 'raised' by Chinese sellers.

Lin Chao and Lin Sheng have grown into billion-level 'big sellers'. They rely on China's supply chain advantages to gradually establish localized teams in Southeast Asia and become leading local players.

However, the road to localization cannot be accomplished overnight and always moves forward in twists and turns.

In 2019, in order to start localized operations, Lin Chao went to Thailand and found a local trader to cooperate.This trading company has more than 200 people. It imports Chinese products, carries out OEM and distributes them locally. It has a value of 10 to 20 million yuan, mainly 3C digital products such as mobile phone accessories and power banks.

After the two parties established cooperation, Lin Chao used the other party's local supply and brand to open local stores on Shopee and other platforms, which is a local self-delivery model.However, as the online scale expanded, offline agents became dissatisfied and conflicts emerged.

'Offline agents came and said that they cannot supply e-commerce and wholesale to offline at the same time, and they must protect the offline business.' Lin Chao found that this trader was tilting towards offline business, causing the operation of online stores to be hindered.

In January 2020, due to the epidemic, the team returned to China, and this cooperation came to an end due to various obstacles. Lin Chao had to temporarily operate a cross-border direct mail business.

In 2021, when the team is all in China, Lin Chao will use third-party service providers to explore the local market in Thailand.This year, when the haze of the epidemic dissipated, he went to Thailand again, laid out 3,000 square meters of warehousing, and set up local customer service, delivery and other personnel.

'When it comes to mobile phone accessories, China has a huge supply chain advantage. There is basically no such supply chain in Southeast Asia..'After solving the local company qualification and warehousing problems, Chinese sellers do not need to worry about goods problems.

storehouse

However, the extremely cost-effective supply chain has also triggered fierce competition among Chinese sellers in the Southeast Asian market.This is especially true in the 3C category. In competition with the same model, the product cycle is often very short.

'When a product becomes popular, many people will follow suit. Maybe three months later, the profit margin will be gone.' Faced with such a situation, Lin Chao said that on the one hand, new products need to be continuously developed, and on the other hand, they need to be optimized. Supply chain efficiency, such as management systems, human efficiency, product selection, etc., needs to be continuously updated and improved in order to gain profits from competition.

In addition, many things in Southeast Asia are purchased from China. In addition to 3C digital products, there are also clothing, household daily necessities, small household appliances, etc. 'For example, Southeast Asia also has a clothing supply chain, but there is no advantage in style and price. It is more cost-effective to buy from China.' '

Speaking of HAN RIVER, the company is deeply involved in the Indonesian market, not only laying out multiple warehouses locally, but also investing in the construction of a local factory in 2021.

Starting in 2021, the company will set up a local person in charge in Indonesia to manage local business.Currently, 30% to 40% of the brand's products sold in Indonesia are assembled and produced by local factories, and 60% are produced in domestic small home appliance industry zones such as Zhongshan, Shunde, Chaoshan and Zhejiang in Guangdong.

HAN RIVER has an independent research and development team that conducts product research and development, mold opening, and then hands it over to the factory for OEM production.The Indonesian factory mainly assembles complete machines, and 80% of spare parts still have to be imported from China.

'At present, the advantages of the domestic supply chain are still relatively obvious, and there are still relatively good opportunities for exporting to these countries.'

Based on supply chain advantages and localization construction, HAN RIVER has led the local fashion trend of small household appliances.

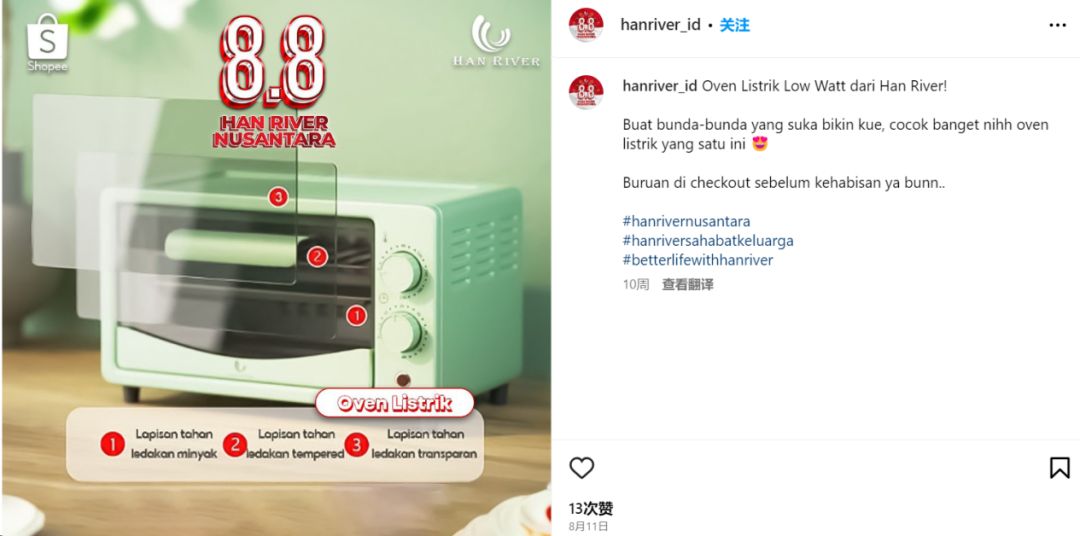

HAN RIVER Oven.Image source: Instagram@hanriver_id

Lin Sheng found that the ovens in Indonesia were all black or red in appearance, which were relatively monotonous, so he took a unique approach and developed ovens in young and fashionable macaron colors such as pink, green, and blue. Once launched, they were well received by consumers and led the way. Following the trend, other sellers followed suit and followed suit.To date, ovens with this type of color have become one of the common small household appliances in Indonesia.

In addition, when Linsheng entered the Indonesian market, except for Philips, there were no other local air fryer brands.In 2020, HAN RIVER's air fryer quickly entered the market and once ranked first in market share.

It can be seen that Chinese sellers in Southeast Asia are constantly driving product innovation and improving the quality of life of local people.

Just two days before the Mid-Autumn Festival, on the evening of September 27, the Indonesian Ministry of Trade issued a Trade Minister Regulation No. 31 of 2023. This regulation stipulates that 'social media is prohibited from being used as a sales platform for goods.'

A ban on social e-commerce has directly affected TikTok Shop, which is booming in Indonesia.无Whether it is Lin Chao or Lin Sheng, they have all boarded the TikTok Shop in the past year, hoping to get a wave of dividends from the start of the new platform.

'For example, in the market of Thailand, the opportunities and dividends brought by TikTok Shop are obvious.' Lin Chao said that the biggest incremental opportunity in the Southeast Asian market is currently brought by TikTok Shop, because it is growing rapidly and various subsidies will More than Shopee and Lazada, sellers may invest lower costs and bring about explosive development.

After the National Day, Lin Chao began to try TikTok Shop in the Philippines and the United States. 'Originally, we also wanted to do it in Indonesia, but due to sudden policies, we did not consider it for the time being.'

Lin Sheng, who is deeply involved in Indonesia, although 70 to 80% of his sales come from Shopee, the TikTok Shop store that has just started to develop has also been affected.

'HAN RIVER is the first batch of brands to cooperate with TikTok Shop to launch the 'little yellow car' at the end of 2021, and has taken many detours. However, TikTok Shop has brought a lot of exposure to the brand, and this year's performance has also exploded. The policy suddenly 'Come for a knife' will have a bigger impact.' But Lin Sheng believes that there should be a plan and a turnaround soon.

Actually,As the process of going overseas deepens, Chinese companies are not only accelerating localization in overseas markets, but also becoming compliant.

Lin Chao pointed out that localization and compliance are major challenges for cross-border sellers.When setting up a company overseas, including recruiting local partners and employees, cross-border conflicts bring many conflicts in terms of culture, trust, politics, etc.; in terms of product compliance, how and when to do it in different countries and regions are all Difficulties to consider.

'It's okay for Chinese sellers to make money locally. But they need to pay taxes legally, drive employment, and not impact the original ecology. Even if the law doesn't originally say that 'social media cannot be used for e-commerce,' the regulations can be modified to allow you Unable to operate.' Lin Chao said.

Taking Lin Chao as an example, his company is paying more and more attention to compliance and recently spent 40,000 yuan on a product certification.After product certification, it is legally compliant in the local area, which increases consumer trust and enhances the company's credibility.

HAN RIVER has focused on compliance from the beginning and followed the ideas of overseas brand operations.Next, Lin Sheng also thought of opening offline stores in Southeast Asian countries such as Indonesia. 'Offline is more difficult to connect. E-commerce companies are actually not good at it. Let's explore slowly.'

Lin Sheng is still firmly optimistic about the opportunities in the Southeast Asian market. He pointed out that the share of e-commerce in Southeast Asia is still relatively small, the products are not rich yet, and there are no particularly large-scale monopolies, so there is still a lot of room for future development and many opportunities.

According to the International Monetary Fund's forecast, the size of Southeast Asia's e-commerce market will grow from US$120 billion in 2021 to US$234 billion by 2025.

Specifically, Indonesia is the largest e-commerce market, and the market size will exceed 100 billion U.S. dollars in 2025; the Philippines, Vietnam, and Thailand are in an explosive period of growth, with rapid development and great potential; while the two mature markets of Singapore and Malaysia continue to remain stable. increase.

The tests of localization and compliance are faced by Chinese sellers, but there are also new business opportunities in the Southeast Asian market.As my country's cooperation with countries and regions along the 'Belt and Road' deepens, new opportunities will continue to arise.